Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

How is it possible to get higher average investment returns while reducing risk — even eliminating the possibility of losses due to stock market decline?

Let us show you how with Index Crediting!

We will compare Index Crediting to the Standard & Poor's 500 (S&P 500) Index .

As of March 13, 2020, the 10 largest companies, with a weighted market cap, in the S&P 500 were:

A S&P 500 Indexed Crediting Account earns the gains in the S&P 500 up to a cap, but loses nothing when the market goes down.

You enjoy most of the gains, but give up the gains above a cap in exchange for cutting out ALL the loses.

As strong as the S&P 500 is, it is still subject to the stock market

roller-coaster volatility ride. Its fate rides with the market, and frequently, it loses money.

Mathematically speaking, the amount you give up above the cap is smaller than the amount you lose when the market goes down.

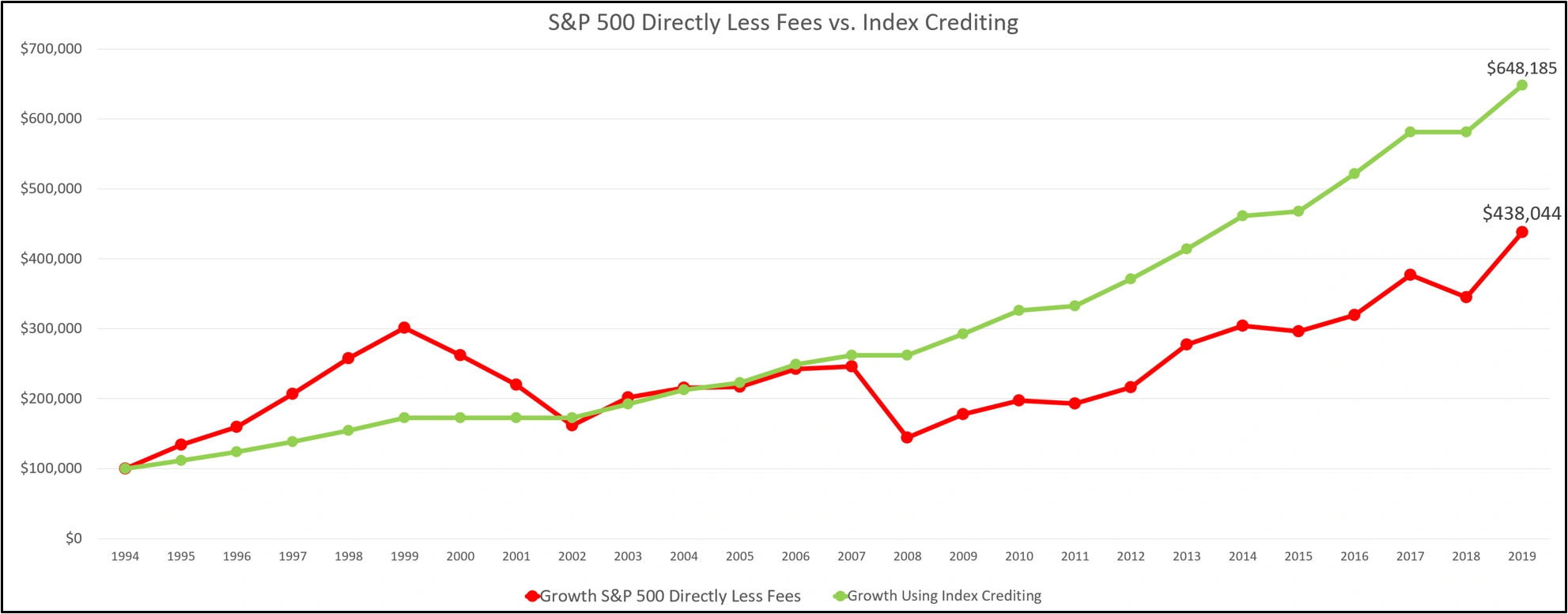

Let's compare performance over the last 25 years:

Although past performance is no guarantee of future results, a look back will help you understand the dynamics of each investing strategy.

If you had invested $100,000 into the S&P 500 (in red) and $100,000 in an S&P 500 Index Crediting account (in green) over the last 25 years, see how they would fair after typical fees.

Clearly the Index Crediting won with $648,185 over the S&P 500's $438,044, but how did Index Crediting earn the extra $210,141 while facing less risk? Through option contracts!

In the case of Index Crediting, your money is not in the market directly. If it was, when the market goes down, so does your account value. With Index Crediting, your money is in a seperate account that earns interest which is then used to purchase option contracts against the S&P 500. During periods when the market goes up, the option contract is exercised and you get the returns up to a cap. When the market goes down, the option is not exercised. This means that you get none of the losses, because your money was not actually in the market.

Mathematically speaking, getting the bulk (up to the cap) of the market returns while avoiding all market downturns outperforms the market as a whole. As it turns out, avoiding market losses is the best way to increase your average investment return while reducing your risk exposure.

It used to be that only the super-wealthy could use this S&P 500 Index Crediting Account strategy. Now there are big, highly-regulated financial companies that will help you implement the strategy.

Fees can eat up more than 50% of your prospective gains!

Copyright © 2020, 2021 Ratigan & Associates

Arizona Department of Insurance and Financial Institutions License #2653905

California Department of Insurance License #0C05823

California Department of Real Estate License #00336265

All Rights Reserved.

Powered by GoDaddy