Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

You would like to be comfortable as a debt free successful investor, but sometimes life gets in the way of your best plans.

With the right strategy you can make it, but...

Lenders give you the bait and hope you'll get hooked, because they make a lot of money in interest and fees.

Americans began 2020 owing more than $1 trillion in credit card debt and the national average APR is a significantly higher 17.8%. By multiplying $1 trillion by 17.8%, then dividing by 52 weeks in a year, you can see:

Lenders' gross interest revenue is over $3.4 Billion dollars per week!

And that is before they start assessing annual fees, late-payment fees, overdraft fees, debt-collection fees, erroneous fees, Monday fees, and "because-they-feel-like it" fees.

While motivation is absolutely critical, so is implementing the right strategy.

We have met so many people who could whip themselves into an emotional frenzy, but despite being highly motivated to take massive action, they are still not getting ahead. This is because they don't have the right strategy.

Pushing twice as hard against a brick wall to get to the other side, just means you get burnt out faster. You may need to find another way:

there is always a doorway to the other side; you just need to find the key.

Firstly, Your Optimal Prosperity Plan™ is customized specifically to your

goals, plans and passions — it is YOUR plan.

Secondly, the right strategies only come out through working the process.

Thirdly, the speed of your success comes from mathematical optimization.

Use our experience to help you find YOUR key.

Imagine a couple that has excessive debts, but wants to be able to retire

debt-free soon with enough financial assets to last for the rest of their lives.

Firstly, in this case they are starting with clear goals. Most people have many conflicting goals.

Secondly however, precisely how to achieve this rapid financial transformation is far more complex. This is where our many years of experience can really help in working through a process to develop the effective strategies specific to their unique situation, capacities and goals.

Thirdly, with our platform, we find and utilizes as many as a hundred or more mathematical accelerators to optimize the speed of their transformation from debt to wealth.

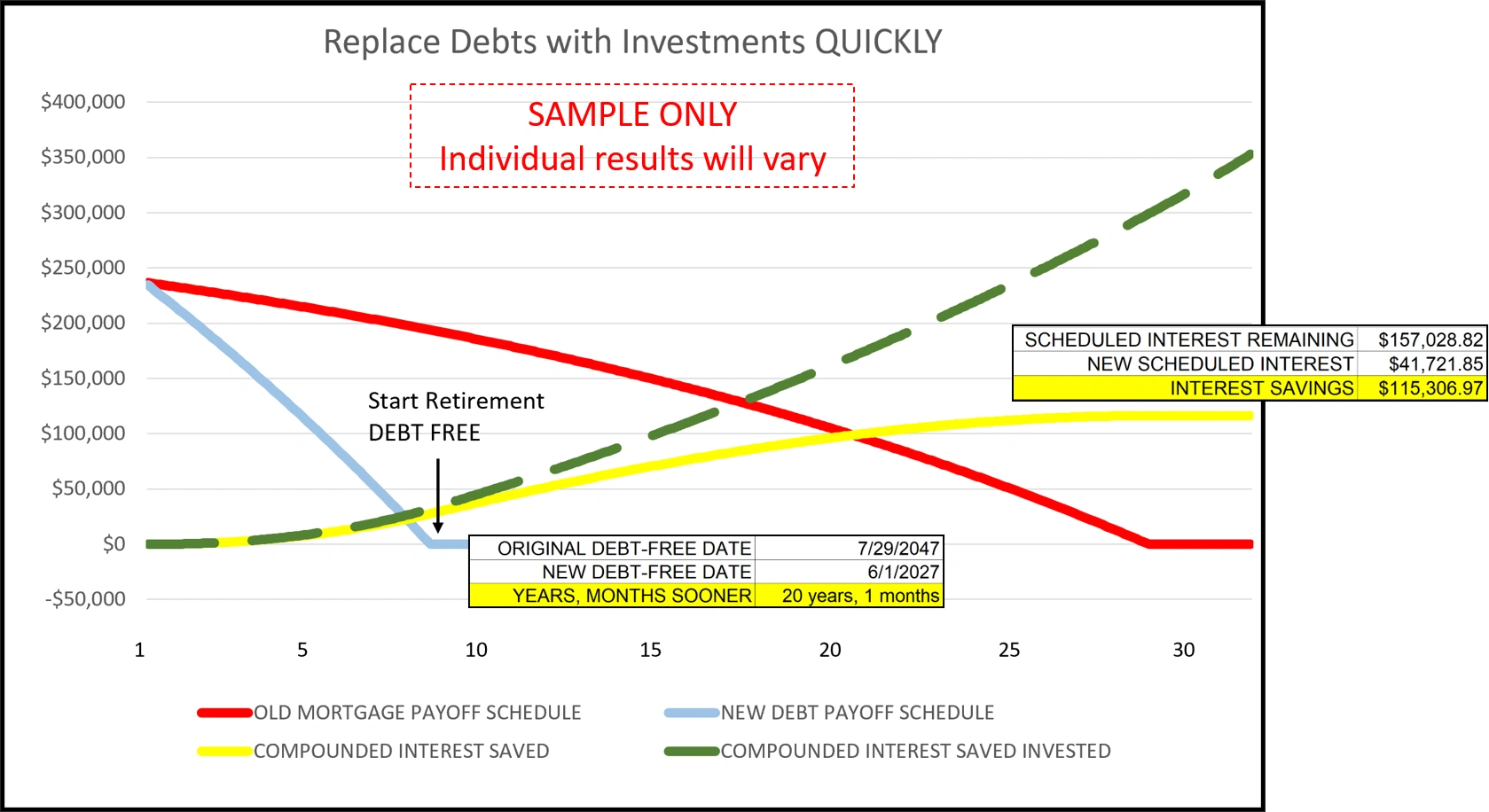

See the dramatic result in the actual client sample below:

The red line shows 27 more years for this couple to finish paying off their home mortgage. This client's challenge is that they expect to retire in about 7 years. Their concern was having to make mortgage payments out of their retirement income. With our utilization of many financial accelerators and mathematical optimization, we were able to cut their payoff time by 20 years and 1 month. They should be able to retire on schedule debt-free and with sufficient risk-mitigated assets.

The key to this rapid acceleration is structuring their finances in such a way as to cut out the bulk of interest. As shown by the yellow line, their interest saved was over $115,300. While we do not guarantee investment returns, if this couple were to redirect their interest savings into an investment account throughout this process (at an example of 6% average return as shown by the green dashed line) they could build up over $300,000 over the next 27 years — when they otherwise would have just finally paid off their old mortgage!

For free, you can learn how people using advanced math can make the difference between retiring wealthy or sliding into poverty during retirement. You can watch our YouTube videos where we will teach you how to do this highly valuable analysis yourself. Or, if you don’t like doing all that math on your own, let us do the work for you with our advanced software and years of experience. The cost will be but a minuscule fraction of the savings we can generate for you — guaranteed.

We guarantee that our calculations will save you at least 10 times as much money as you will pay for them, otherwise our service is free.

You will have more peace of mind knowing you are implementing your own plan with greater precision.

You will find this goal planning and optimization process will teach you vital skills that you can use for the rest of your life.

Listen to Austin Greiner Sr., one of our Debt to Wealth specialists talk about his journey and discover critical insights that will help you advance rapidly and become your best self!

Copyright © 2020, 2021 Ratigan & Associates

Arizona Department of Insurance and Financial Institutions License #2653905

California Department of Insurance License #0C05823

California Department of Real Estate License #00336265

All Rights Reserved.

Powered by GoDaddy